amazon flex taxes form

Generally payments to a corporation including a limited liability company LLC that is treated as a C- or S-Corporation do not receive. Keeper helps you to.

What Is A 1099 Form What Freelancers Need To Know

The main tax form you need to file is Schedule C.

. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports. Tax Returns for Amazon Flex Youll need to declare your amazon flex taxes under the rules of HMRC self-assessment. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C.

Are you making money by driving for Amazon Flex. 410 Terry Avenue North Seattle WA 98109 What forms do you file with your tax return. Click ViewEdit and then click Find Forms.

This video shares information on where to find your 1099 expenses you should take into account to reduce your taxable i. Yes say Cash and enter the whole total. Which Turbo Tax Section.

The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and. Amazon will send you a 1099 tax form stating your taxable income for the year. And finally downloadprint your 1099-K.

Sign in using the email and password associated with your account. We will issue a 1099 form by January 29 to any Amazon Associate who received payments of 600 or more or received payments where taxes were withheld in the previous calendar year unless you are an exempt entity. Click Download to download copies of the desired forms.

41 out of 5 stars. This is where you enter your delivery income and business deductions. Use your own vehicle to deliver packages for Amazon as a way of earning extra money to move you closer to your goals.

Amazon Flex Business Address. Amazon Flex - US. We would like to show you a description here but the site wont allow us.

Self-Assessment Guides Keeping Tax Records. This form will have you adjust your 1099 income for the number of miles driven. Youll need to submit a tax return online declaring your income and expenses once a year by 31 January as well as paying tax twice a year by 31 January and 31 July.

Created Jul 5 2016. Was this information helpful. To download your form electronically follow these steps.

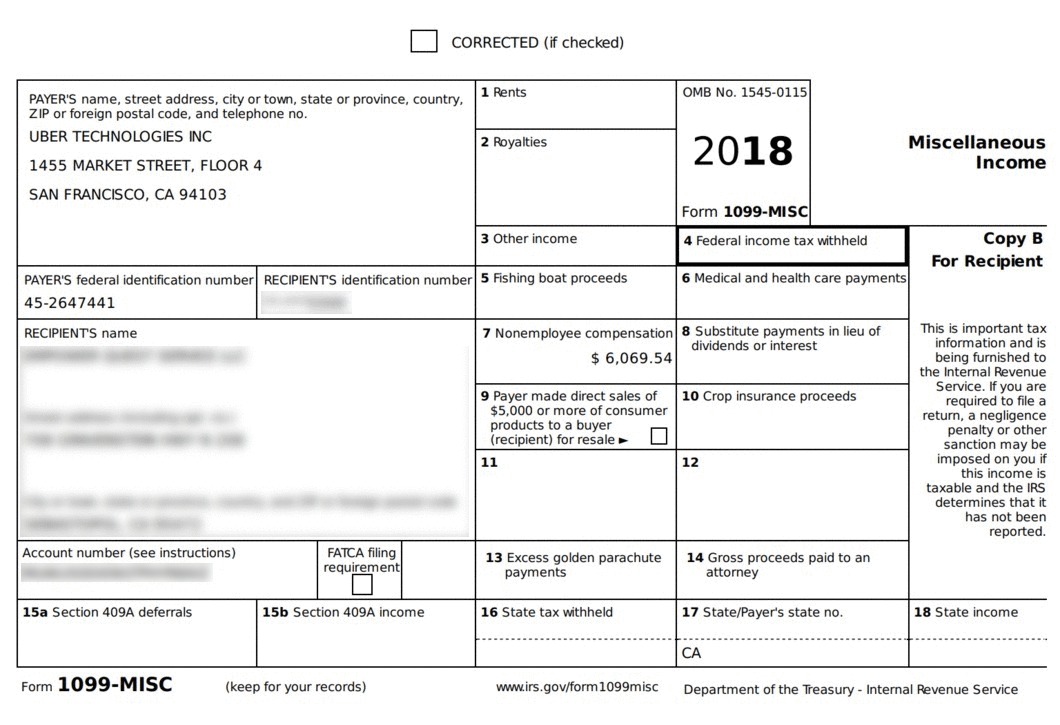

Schedule C is part of. Your 2018 IRS Form 1099-MISC is now available. Amazon Flex quartly tax payments.

In fact you can enter all your self employment income as cash and not need to enter the 1099NECs. This is the non-employee compensation 1099 form you receive from Amazon Flex if you earn at least 600 with them if it is under 600 you will not receive the form -- but still have to report the income otherwise youll receive filing penalties. Gig Economy Masters Course.

Get it as soon as Tue Mar 8. FREE Shipping on orders over 25 shipped by Amazon. In the Year-end tax forms section click Find Forms Click Download.

First login to your Amazon Seller account. From there select the Tax Document library. This is your business income on which you owe taxes.

Its almost time to file your taxes. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400. But if you havent heard from them about your 1099-K you can find the form by following these simple steps.

This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program. Amazon Flex Business Phone. Only the total goes to Schedule C line 1.

The forms are also sent to the IRS so take note if youve made more than 600 in the relevant tax year. Here are some of the most frequently-received 1099 forms received by Amazon drivers. Amazon Flex Legal Business Name.

If youre looking for a place to discuss DSP topics head over to ramazondspdrivers. Amazon Flex Doordash Mercari Offer Up and 1099 Job. In your example you made 10000 on your 1099 and drove 10000 miles.

Next click on the Reports menu. Most drivers earn 18-25 an hour. Complete 1099 misc Forms for 2021 and 1096 Tax Form and self Seal envelopes All 1099 Government Approved 2021 kit for 10 vendors.

Increase Your Earnings. Understand that this has nothing to do with whether you take the standard deduction.

How To File Amazon Flex 1099 Taxes The Easy Way

How To Get 1099 From Amazon Flex Bikehike

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How To Do Taxes For Amazon Flex Youtube

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To File Self Employment Taxes Step By Step Your Guide

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

Completing Your Tax Information In Seller Central For Amazon Payments Youtube

How To File Amazon Flex 1099 Taxes The Easy Way

Anyone Else Getting This Exactly 5000 00 Pay For 2019 I Have Trouble Believing That My Random Blocks And Whole Foods Flex Delivery Work Paid Me Exactly 5000 00 R Amazonflexdrivers